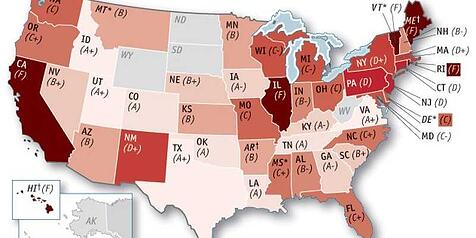

The Best Home-State for your Business

Incorporation is a state-level process so you must choose a state in which to form your corporation. This becomes your “home state” or “domestic state”. For most businesses this is the state where your headquarters are located, whether it’s your garage or a corporate suite.

If a company chooses to form in a state where they are not located or if the company conducts business nationally, internationally, or is not U.S.-based, the home state chosen will be based on costs to form, taxes and other legal factors.

If a company chooses to form in a state where they are not located or if the company conducts business nationally, internationally, or is not U.S.-based, the home state chosen will be based on costs to form, taxes and other legal factors.

Popular Formation States

Delaware – low formation cost, moderate annual fees, no state income tax and the most favorable legal environment (Chancery Court with well-developed laws)

Nevada – low formation cost, moderate annual fees, no state income tax, similar legal environment to Delaware but with shorter case history)

Wyoming – low formation cost, low annual fees, no state income tax (tax on assets held in Wyoming), corporate and LLC laws which are favorable to corporations.

Florida – low formation cost, moderate annual fees, good online business infrastructure.

South Dakota – moderate formation cost, low annual fees

Colorado – low formation cost, low annual fees

For businesses outside of the U.S., some choose New York or DC as a formation state due to the prestige of the location, particularly in foreign markets. Neither would be considered low cost, however some U.S. based businesses might find the prestige factor useful for their line of products or services.

Please keep in mind that if you choose to form outside of your home-state, you may have to file as a “foreign corporation” in your state. This “foreign” designation is what states use to differentiate between companies that began their corporate life (filed the papers) in-state (domestic), as opposed to registering after forming in another state.

For more information on state by state incorporation visit our page: Which State?

Find the answers to all of your major incorporation questions in our new eBook

Call:

Call:  Live Chat

Live Chat