What is an LLC?

The Limited Liability Company is a relatively new entity type that was developed towards the end of the 20th century as an alternative to a corporation. Modeled after a German entity type (GmBH), the US LLC originated in Wyoming in the late 1970s, emerged in Florida a decade later and by the early 1990s existed in all US jurisdictions. Since that time limited liability companies have steadily gained in popularity largely because they combine liability protection previously reserved for corporations with single taxation of partnerships. LLCs also have fewer requirements than corporations making them easier to maintain. LLC's are separate and distinct from its owners who are called "members." LLC's do not issue shares of stock like C Corporations and S Corporations. If you would like to read about S Corps and C Corps check out our blog here.

Ownership/ Member details about LLC's

There are 2 ways to reflect ownership of an LLC. It can be reflected as a percentage or by membership units which are similar to shares of stock in a corporation. The number of members of an LLC is unlimited and members can be individuals, partnerships, corporations, trust, nonresident aliens, etc.

Things to know about LLC's

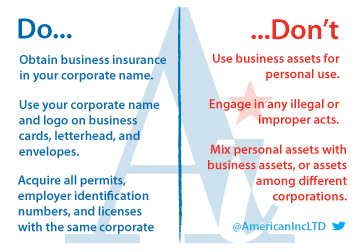

- Limited Liability- Absent any specific personal guarantees, the amount at risk for members is limited to their investment in the LLC. The personal assets of the members are generally beyond the reach of creditors. This protection is for all members of the LLC unlike an LLP where one general partner must remain liable for partnership debts.

- Tax Benefits- LLC members may also enjoy the same flow-through tax benefits which are applicable to partners of a partnership.

- Easier to maintain- LLC's are not required to hold annual meeting and to record meeting minutes. LLC's are known for their operational ease.

- Heightened Credibility- Forming your company into an LLC can increase the credibility associated with your business.

Call:

Call:  Live Chat

Live Chat